Financial Habits and Health Survey Finds 60% of Workers Have Tightened Belts Due To Layoff Concerns

Create Your Resume Now

On February 15, 2024, Zety surveyed 1,000 U.S.-based workers to better understand the relationship between people’s careers, financial situations, and spending habits.

Key findings of Zety’s Financial Habits and Health Survey:

- Roughly two-thirds (60%) are trying to spend less because they're worried about layoffs.

- Half (53%) are reducing their spending due to concerns about the cooling job market.

- 85% say inflation has impacted their spending habits.

- 42% say their financial situation is less stable today than last year.

- 45% feel that they are underpaid.

- For half (51%), their bonuses were non-existent or lower than expected.

Workers’ Worries and Spending Habits

Feeling growing money-related stress, people are trying to reduce spending. This shift is directly related to worries regarding layoffs and rising inflation.

- 6 in 10 are trying to spend less because they are worried about layoffs or job loss.

- 53% claim they spend less due to concerns about the tight job market.

- 85% admit inflation impacts their spending habits, with 48% trying to spend less and 37% cutting way back on their spending.

- 68% will alter their summer vacation plans this year to save money.

Workers’ Financial Situation & Money-Related Challenges

- More than 4 in 10 (42%) consider their financial situation less stable today than last year. 23% describe themselves as much less financially stable now compared to last year, and 19% as slightly less financially stable.

- At the same time, 36% say their financial situation is about the same, and 22% report they are more stable financially in 2024 than they were in 2023.

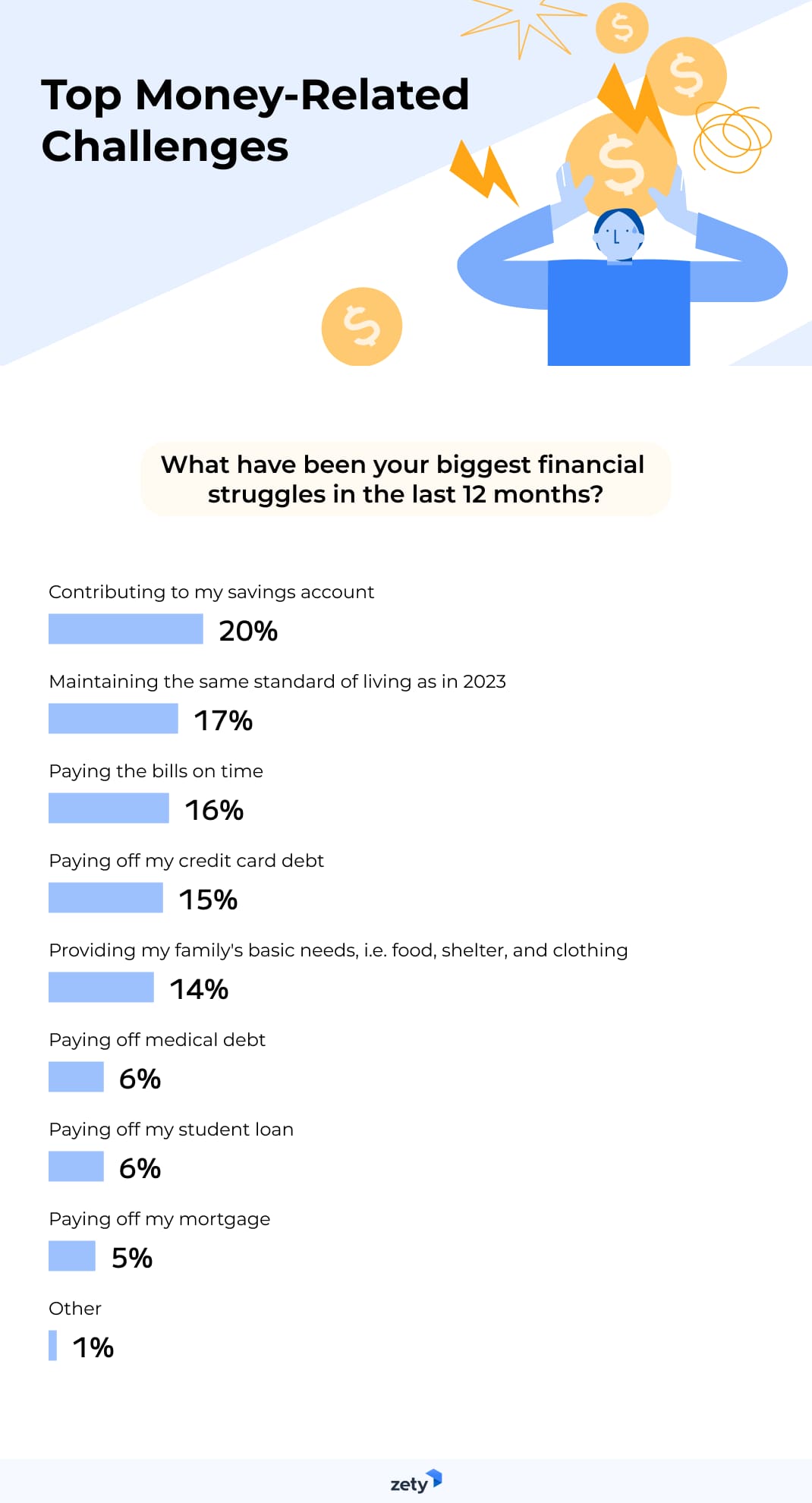

Respondents also opened up on the top money-related challenges they face. Below is the full breakdown of their answers.

What have been your biggest financial struggles in the last 12 months?

- Contributing to my savings account – 20%

- Maintaining the same standard of living as in 2023 – 17%

- Paying the bills on time – 16%

- Paying off my credit card debt – 15%

- Providing my family's basic needs, i.e. food, shelter, and clothing – 14%

- Paying off medical debt – 6%

- Paying off my student loan – 6%

- Paying off my mortgage – 5%

- Other – 1%

Only 1 in 20 claim they do not have any financial struggles in 2024.

Salary & Bonuses

Time to investigate salaries and bonuses.

- Almost half (45%) of workers feel that they are underpaid (with 26% considering themselves as very underpaid and 19% as slightly underpaid)

- On the contrary, 1 in 10 say they are overpaid (5% very overpaid, 5% slightly overpaid), and 45% believe they are paid fairly.

Additionally, for half (51%) of those surveyed, their bonuses came as an unpleasant surprise. They were either non-existent or lower than expected in 2023.

- Nearly 1 in 5 (18%) did not get a bonus in 2023, even though they were expecting one.

- For 18%, it was a little lower, and for 15%a lot lower than expected.

On a positive note, despite all the financial struggles, for a vast majority of employees, money is not the most important aspect of their professional lives. 69% of participants prioritize a good work-life balance over a higher salary. Respondents reported they would not accept a different job for a 30% or higher salary if they knew they would have a horrible work-life balance. Similarly, 57% would not accept such an offer if it meant having a toxic boss.

Some More Notable Findings to Mention

Digging deeper, we also discovered the following:

- Pay transparency should be a modern workplace trademark. 66% of respondents wish companies posted the salary ranges of all their employees.

- Salary range (26%), health benefits/insurance (17%), flexible schedule options (13%), and details about job duties (13%) are considered the most important information in a job posting (excluding job summary and minimum education/work experience).

- Love may not always be blind, but it seems surprisingly trustful. And not bothered by such down-to-earth issues as money. 36% of participants admit they didn't know precisely how much debt their spouse had carried before they got married.

April is National Financial Literacy Month. Empower yourself in knowledge, try to turn worry into action, seize the reins of your finances, and chart a course toward brighter horizons.